Our professionals bring a unique and valuable combination of international perspective and sector expertise, developed over decades of advising in MA and corporate transactions for the life sciences vertical and other interesting industries; experience in structuring and closing complex financial deals; and strong relationships with industry professionals globally.

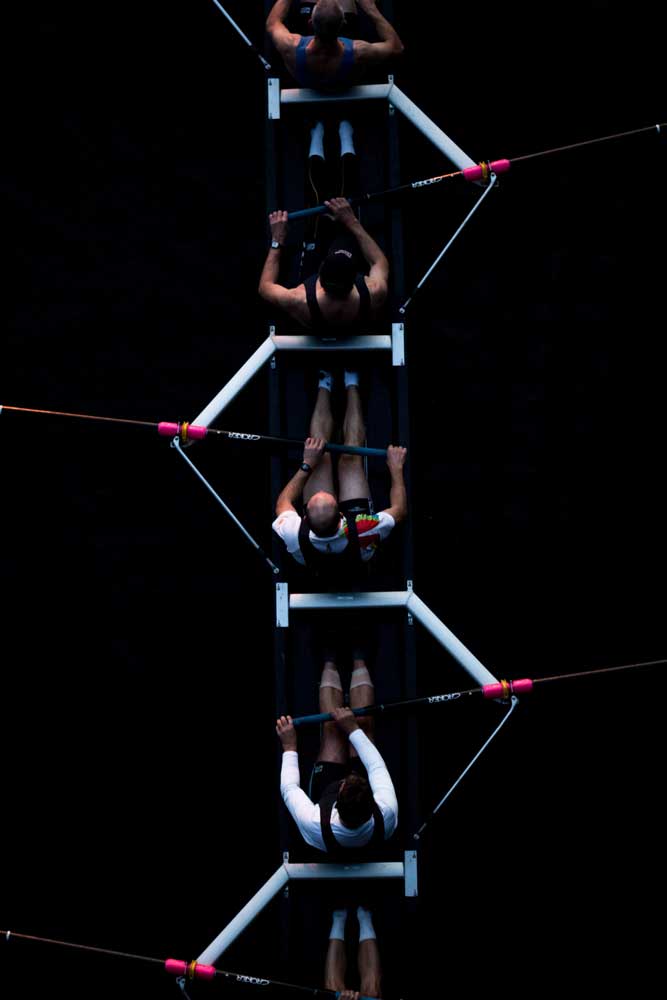

Team

Our services are offered by professionals who have done it before.

We have received many “no’s”, have seen many deals fail in the last minute at the notary, and dealt with many stakeholders that complicated rather than facilitated the deal process.

But above all: We have successfully closed many transactions and financing rounds. We know how to make a company “sellable” and a startup “investable”. We have written many Teasers, equity stories and Memorandums. We know how to put your strengths into the spotlight, and how to deal with your weaknesses. And last but not least: We have a deep target and investor network in our specific industries.

Juan has over 30 years Investment Banking experience. He specializes in M&A transactions, Private Equity investments and Venture Capital projects. Prior to founding the M&A boutique Boltendahl International Partners in 1996, he worked with Deutsche Bank in Frankfurt, with the ING Group in Montevideo and with Banco Medefin in Buenos Aires.

More info

He is an advisor of international companies and major funds in its acquisition and divestment strategies. His sector expertise focuses on the Life Sciences industries: Pharmaceuticals and Healthcare, Biotech, Medical devices, Animal health, medTech, Wellness Tech, Retail Health, Enterprise Health, CDMOs, CROs. His corporate finance expertise started back in the early 90’s while holding and representing major shareholders in Asbach Co., Germany’s biggest brandy company, in its divestment process to the Guinness/United Distillers Group.

His most recent deals include the acquisition of a EUR 15m+ Healthcare company in Germany, the sale of iconic Ceregumil brand to Uriach in Spain, the acquisition of the Riverside portfolio company Euromed SA by the listed German company Dermapharm Holding SE, a EUR 270m+ deal; Series A CHF 9.5m and Series B CHF 30m private placements in Swiss MedTech Fertility company Ava AG; the sale of Spanish CRO company Villapharma Research to listed group Eurofins Scientific; the closing of the debt tranche for the Spanish private equity powerhouse Portobello Capital in its acquisition of the leading digital signage company Trison; two Series A and B investments in the Israeli company Corephotonics Ltd., later sold to Samsung; a series D investment in the American company CloverFoodLab; the divestment and DLA Agreement with Valeant / Bausch+Lomb for a Swiss pharmaceutical client and the acquisition of a logistics leader in Spain for the French company Groupe CAT.

Juan is member of the IESE Alumni Association of Madrid and a founding member of the IESE Junta Territorial (IESE Regional Board) in Argentina and Uruguay. Juan obtained his MBA at IESE in Barcelona and Columbia University of New York. He speaks Spanish, English, German, Portuguese and French.

His most recent deals include the acquisition of a EUR 15m+ Healthcare company in Germany, the sale of iconic Ceregumil brand to Uriach in Spain, the acquisition of the Riverside portfolio company Euromed SA by the listed German company Dermapharm Holding SE, a EUR 270m+ deal; Series A CHF 9.5m and Series B CHF 30m private placements in Swiss MedTech Fertility company Ava AG; the sale of Spanish CRO company Villapharma Research to listed group Eurofins Scientific; the closing of the debt tranche for the Spanish private equity powerhouse Portobello Capital in its acquisition of the leading digital signage company Trison; two Series A and B investments in the Israeli company Corephotonics Ltd., later sold to Samsung; a series D investment in the American company CloverFoodLab; the divestment and DLA Agreement with Valeant / Bausch+Lomb for a Swiss pharmaceutical client and the acquisition of a logistics leader in Spain for the French company Groupe CAT.

Juan is member of the IESE Alumni Association of Madrid and a founding member of the IESE Junta Territorial (IESE Regional Board) in Argentina and Uruguay. Juan obtained his MBA at IESE in Barcelona and Columbia University of New York. He speaks Spanish, English, German, Portuguese and French.

Erik has over 30 years of Investment Banking experience. He is specialized in the origination of MA transactions and pharmaceutical business development. Erik is a Board Member and advisor of international companies and Life Sciences related Funds, as such Erik has a deep knowledge within the Pharma and Biotech industries.

More info

Erik has over 30 years of Investment Banking experience. He is specialized in the origination of MA transactions and pharmaceutical business development. Erik is a Board Member and advisor of international companies and Life Sciences related Funds, as such Erik has a deep knowledge within the Pharma and Biotech industries.

In 1984, Erik joined J.P. Morgan where he worked in the Zurich and New York offices, in commercial banking and investment banking management positions. Erik has also negotiated corporate partnerships with multinational pharmaceutical and biotechnology companies such as Amgen Inc., USA; Celgene Corporation, USA; Astellas Pharma, Chicago USA and Novartis, Switzerland. He originated and advised in a major acquisition by Novartis (Sandoz) in Argentina.

Erik es actualmente miembro de varios Consejos de Administración de empresas latinoamericanas, asesor de Adium Pharma, Montevideo, Uruguay. Es vicepresidente de Perutil, un fondo de inversión con sede en Panamá. Participa en un proyecto educativo público en Montevideo, Uruguay, Fundación Retoño.

Born in 1957, Erik obtained his Master of Economics at the University of St. Gallen in Switzerland; is married and has two children. He has the Swiss and Argentine nationalities and speaks German, English and Spanish.

Charles has over 25 years’ experience in Mergers Acquisitions, Operations and Human Resources in the Healthcare Industry. Before joining Boltendahl, he worked as EVP Global Operations for Nycomed, as EVP Human Resources at Takeda, and was a Partner for five years at AVP in Zurich, Switzerland, now part of the Roland Berger Company.

More info

During his twenty-five years in industry, he gained extensive expertise in the areas of Operations, Supply-chain and People Management. Since he retired from Takeda in 2013, Charles has been involved in many MA transactions and actively involved in portfolio companies for Private Equity firms such as Avista Capital Partners, Nordic Capital and Athyrium Capital Management.

Charles is a graduate of the Electro-Mechanical Engineering Brussels Free University, and MBA alumni from New York University, Stern Business School.

Guillermo is a graduate in Law and Social Sciences from the University of the Republic, Uruguay, he possesses over ten years of experience in the legal corporate field.

More info

Between the years 2005 and 2015, Guillermo worked at several of the most prestigious law firms in Uruguay, such as Posadas and Posadas Vecino. Furthermore, he worked as a legal counsel for BAF CAPITAL, the investment fund management company, where he performed Investment Management activities.

Guillermo is proficient in different fields of law, including: commercial law, corporate law, sports law and intellectual property, having also developed and assessed real estate businesses in the area. Among other activities, he presently conducts legal counseling at the prestigious and popular Club Nacional de Football. Along his legal expertise, Guillermo presents a defined commercial profile, and speaks Spanish, English and Portuguese.

Wolfgang has 20+ years of management experience with international entrepreneurial and worldwide business development capabilities.

More info

In 2004 he founded Secuvita, SL a leading UCB company in Spain. He has achieved an important stature in the biotechnology space in Spain, leading a premium brand in the nascent Stem Cell Storage industry. His expertise ranges from founding, to leading through seed phase, to guiding of full commercialization to obtain profitability, to strategic guidance and positioning, and to international expansions.

Prior to that he worked as a General Manager for IDOC in Rio de Janeiro, leading the firm to become one of the first companies to achieve ISP status in Brazil, building a Web Development/E-business consulting unit, featuring www.infoinvest.com.br, the premier Brazilian Investor Relations Portal, with a significant client base in the financial services sector.

Following that experience he served for 6 years as a VP of worldwide Operations at Bowne Global Solutions, a leading US based technology company (after BGS acquired IDOC).

Wolfgang obtained his International Executive MBA from IE in Madrid and graduated in Sociology and Psychology from the University of Vienna. He speaks German, English, Spanish and Portuguese.

Stephan Lobmeyr es actualmente Partner de Capital D y Director General de Change Capital Partners. Prior to joining Change Capital, Stephan was a director of Hicks Muse, Tate&Furst, which he joined in 1999 and was part of the team that started Hicks Muse’s European operations and invested its EUR 1.5bn European Fund.

More info

Durante sus años en Hicks Muse, Stephan llevó a cabo varias salidas a bolsa,financiamientos, fusiones y adquisiciones. Antes de unirse a Hicks Muse, Stephan pasó seis años como consultor estratégico de The Boston Consulting Group, posteriormente como Director en sus oficinas de París y Buenos Aires. Stephan tiene un MBA por el IESE, Barcelona y una licenciatura en comercio por Wirtschaftsuniversität, de Viena.

Roger began his professional career in 1984 at Price Waterhouse in London, later moving to Madrid. His main activities within Price Waterhouse were the audit of the banking sector and due-diligence work in different acquisitions and MBOs.

More info

In 1990, he joined the Department of International Finance Bank to develop programs Hispano debt conversion and privatization in South America. Participates in the privatization of telephone services, airlines and highways in Argentina and Chile.

In 1994, he joined as International Director of Leche Pascual Group’s strategy to develop exports and investments abroad. In 1999 creates a foreign trade company specializing in export and trading of dairy and meat products.

Roger holds a degree in Biology from Imperial College – University of London and Chartered Accountant in England and Wales.

Roberto is the Founder and Managing Partner of BetaAngels Management LLC and is based in Madrid. Since 1995, he has been dedicated to venture capital, having directly led 20 investments and overseen many others.

More info

Roberto has invested in companies based both in the US, Europe, Israel and Latin America. Direct operations have returned several times the invested capital, and include efforts such as eDreams (Spain), Eyesquad (Israel) and Global Energy (US/Costa Rica). Roberto currently manages the investments of BetaAngels in Corephotonics (Israel) and Clover Food Lab in Boston, US, where he is also a board member.

Roberto was born and raised in Panama. He graduated from Dartmouth College (BA, Computer Science with honors Summa Cum Laude) and Harvard Business School (MBA). He has been a member of YPO / WPO since 1992 and recognized as Global Leader for Tomorrow by the World Economic Forum. He is a citizen of Panama and Spain, proud father of 3 children and tries to keep his golf handicap in a one figure score.

Bettina was part of Boltendahl International at the operating level from 1997 to 2005, now maintaining an External Advisory role. Before Boltendahl she has worked at Dresdner Bank in Frankfurt, and Roche Laboratories in Montevideo.

More info

After Boltendahl, Bettina has worked in Penna PLC, in Vestas as HR Director and lately as HR Director of Vodafone Europe Cluster, Germany and Spain. She specializes in human resources and strategy.

She concluded her studies of economics at US Ivy League Brown University, with an acknowledgment “Magna Cum Laude” and a Masters in International Business at the École des Ponts ParisTech, France. She speaks and writes fluent German, English, French and Spanish.